My Products

Term Life Insurance

Term insurance covers you for a specific number of years – and is the lowest cost life insurance.

Get a Quote

Permanent Life Insurance

Permanent insurance provides guaranteed coverage for life as well as estate and retirement planning.

Get a Quote

Segregated Funds

Segregated funds combine the growth potential of investment funds with insurance protection.

Get a Quote

Critical Illness Insurance

Critical illness insurance can protect you financially if you suffer a serious illness.

Get a Quote

Disability Insurance

Disability insurance can replace some of your lost income if you miss work due to illness or injury.

Get a Quote

Critical Illness - Laurence's story

Three years ago, Laurence was diagnosed with prostate cancer. This is his story.

Coverage for the important people in your life.

It's important to make informed decisions about protecting your loved ones financially.

Insurance and Investment Calculators

Cash Flow

Access Calculator

Mortgage Loan Payment

Access Calculator

Net Worth

Access Calculator

Retirement

Access Calculator

How Long Will the Money Last

Access Calculator

RRIF Payment

Access Calculator

LIF Payment

Access Calculator

RRSP Tax Savings

Access Calculator

Savings Growth

Access Calculator

Savings to Reach a Goal

Access Calculator

Life Insurance Needs Analysis

Access Calculator

Critical Illness Needs Analysis

Access Calculator

Disability Life Needs Analysis

Access Calculator

Start Education Planning Now

Access CalculatorDollar Cost Averaging

If market volatility has caused you to transfer your

money into GICs or cash, you may want to ask

yourself if you are still on track to meeting your

personal goals. Whether it’s saving for retirement,

a home or a child’s education, keeping money in a

lower-earning investment option may not give you the

growth you need.

My goal is to find the most effective way to put

your money to work and build up your wealth. There

is a tried and tested strategy for investing called

Dollar Cost Averaging (DCA), which smooths out the

costs of investing by regularly buying over time.

One way to do this is investing a lump sum of money

into a temporary safe haven investment holding (ex:

money market) to avoid market volatility and then

systematically switch portions of that into your

target investment(s) over a regular period of time.

This helps you avoid the risk of market timing.

Another way the DCA strategy can be achieved is by

Pre-Authorized Contributions (PACs). PACs allows you

to make withdrawals directly from a saving or

chequing account and then deposit the amount to a

particular investment(s) on a regular basis, such as

monthly or bi-weekly. This will allow your savings

to grow automatically.

Dollar Cost Averaging is right for all

markets

- In a falling market: DCA can let you purchase more securities

- In a rising market: DCA can protect you from paying too much

- In a flat market: DCA ensures you always stay invested

Benefits of Pre-Authorized

Contributions:

- Helps you stick to your plan

- Takes advantage of compound growth

- Eliminates the guesswork of when to invest

- Helps you avoid the rush of yearly RRSP contributions

Double your PAC

Even small increases to a PAC can help you reach

your long-term goals faster. The chart below

illustrates the impact of doubling your PAC on a

monthly contribution overtime of $50 increased to

$100, and $250 increased to $500.

Assumes a 4% annualized rate of return. Used only to

illustrate the effects of compound growth rate and

is not intended to reflect future values of any

particular investment.

This investment strategy helps you minimize

volatility and avoid the risk of market timing. It

is not a one-day initiative but rather a continuous

long-term activity. The earlier you start investing,

the better you will be in the future. I look forward

to discussing these with you in more detail and

seeing how these strategies could assist you in

achieving your goals.

Let’s get started!

Elite Pricing

An important part of investing is making sure you

invest wisely. Even if you invest wisely, you might

still be leaving money on the table if you do not

pay extra attention to your investment fees. You

might remember the old saying, “A penny saved is a

penny earned”. The same idea can be applied to your

investment costs.

You can potentially save thousands of dollars every

year by lowering your investing fees.

One way to access lower investment costs is through

Elite or Preferred Pricing programs. Elite Pricing

is a great way to ensure you keep more of your

money, and it is worthwhile to explore your

options.

How does Elite Pricing

work?

One might think that Elite Pricing or Private Client

programs are available only for wealthy investors.

Fortunately, Elite Pricing is available through most

programs for asset levels starting at $100,000. In

some instances, companies will also have automatic

discounting available to ensure investors receive

fee discounts as soon as they are eligible. So, how

does one know if they are eligible and what are the

criteria? Most investment companies will provide

discounts on fees that are based on the assets

invested. The investment company may also look at

several criteria for discounting such as:

- Fund-level discounts

- Account-level rebates

- Householding

If an Elite Pricing program is geared toward

High-Net-Worth clients, investors may also receive

added features such as: an annual review, and

investment rebalancing services.

As you can see there are many ways that you, as an

investor, can qualify for Elite Pricing. Let’s

connect soon to discuss your plan, and which Elite

Pricing option is best for you.

Contact me today and let’s see how much money you

can save!

RESP Benefits

A Registered Education Savings Plan (RESP) is a special savings account to help Canadian residents save for a child’s post-secondary education.

Benefits include:

- Help you systematically save and plan for a

child’s education

-

Tax-sheltered growth – there’s no taxes payable

on the money earned in a RESP until it’s

withdrawn

-

Government Grants – Government matches 20% of

RESP contributions up to $2,500 each year and to

a lifetime maximum of $7,200

- Additional Grants available for low-income

families

-

Ability to catch up for any prior years you

missed contributing

-

Save on your own schedule - No pre-defined

savings structure within lifetime contribution

limit of $50,000

-

RESP loans can be used to maximize the

Government Grant

-

Most part-time and full-time post-secondary

education qualifies for purposes of a

withdrawal

- With a Family RESP, if one sibling doesn’t pursue post-secondary education, other siblings can use their grant money

Let me help you make the best choices based on

your needs and your situation.

Maximize your RESP

The Registered Education Savings Plan (RESP) is an

investment program where the Government matches 20%

of your contributions. You could even qualify for

additional Grants based on your family income.

There’s also the Canada Learning Bond where the

Government offers up to $2000 for low-income

families.

Start Early

Families with young children can benefit the most

from the RESP. That’s because they will have more

time to qualify for Government Grants, which can be

maximized by contributing to the RESP each year.

Don’t worry! If you miss a year, you can catch up

for one year at a time.

Family Time

If you have more than one child, you can open a

Family RESP. It allows you to keep your savings in a

single account, it simplifies managing the

investments, and if one child doesn’t go to school,

a sibling can use their Government Grant money

without penalty (up to a maximum of $7,200 per

child).

Paying for Education

Most post-secondary programs qualify for educational

withdrawals: academic programs, skilled trade

programs, full-time programs and part-time programs.

Studying abroad also qualifies!

Top Up

If you haven’t yet maximized your RESP contribution

for the year, you can still make a deposit before

the end of December. I can help you calculate the

optimal amount to contribute for this year, or as a

regular monthly deposit.

Let me help you get the most government money that

your child qualifies for.

Beat the Banks

The traditional approach to banking means that each

month millions of Canadians jump through financial

hoops to meet their expenses, pay their bills, cover

borrowing costs and (try to) put something away into

savings and investments.

Most Canadians manage their finances by doing two

things:

- Depositing their income and other short-term assets into chequing and savings accounts.

- Borrowing when they need to, through mortgages, lines of credit, personal loans, and credit cards.

Sounds simple enough. Unfortunately, they usually

receive low or no interest on the money they

deposit, while they pay high interest on the money

they borrow.

Wouldn’t it make more sense if the deposits and

borrowings were combined? Why not have every dollar

you earn paying down your debts until you need to

spend that money?

All-in-one account

One of the most efficient ways of managing debt and

cash flow is to use an all-in-one account, in which

all your savings are directly applied to all your

debt.

In that way, your savings and income automatically

reduce your debt to save you interest.

You can have a combination of your borrowing with a

fixed rate and another portion of your debt in an

open line of credit. The fixed-rate accounts can

help provide payment certainty in a rising interest

rate environment. This approach can reduce interest

costs and lower the risk of overspending in the

account. You can create a tailored debt management

system based on your needs:

- Income

- Lifestyle

- Cash flow surplus (undesignated money left over at the end of the month)

- Interest rate risk tolerance

- Understanding of good debt versus bad debt

Fixed or variable mortgage rates - which one

is right for me?

If you’re looking for a traditional mortgage, you

may not completely understand the difference between

fixed rate and variable rate mortgages. Each has its

own benefits, and your choice will depend on your

situation and your personal preferences. I have

partners that not only can help with this but have

amazing rates too!

Chequing vs Savings

Instead of juggling between a chequing and a savings

account, why not have an option where you can enjoy

the best of both?

Most banks want you to operate with multiple bank

accounts. It's important to know that you're not

maximizing your money by using a separate chequing

and savings account.

There are solutions that can help you benefit from

the higher interest rate of a savings account, along

with the liquidity of a chequing account.

Allow me to refer you to one of my partners that can

assist with any of your banking needs! Together, we

can beat the banks!

Introduction to Segregated Funds

Investing your money is an effective way to put your

money to work and build your wealth. By investing

smart, it helps give you more flexibility to earn

more on your money, build more security for your

retirement, and ultimately give you the chance at

achieving your financial goals and dreams. However,

investing comes with risks. Segregated funds can

help prevent these risks!

Segregated Funds: Investing with peace of

mind

Segregated Funds allow you to invest your money and

help grow your wealth but also gives you peace of

mind knowing that you have protection against

uncertainty.

Unlike other investment options, segregated funds

give you features that aren’t found in the typical

investments (ex. Mutual funds, stocks and GICS):

- Guarantees on your principal – money you invest is guaranteed up to 75% or 100% upon maturity and death

- Reset Options – lets you lock-in market gains that can increase the amount payable upon maturity or death

- Bypass probate – death benefits paid directly to named beneficiary instead of your estate ensures privacy and helps avoid the lengthy and costly process of going through probate

- Potential creditor protection – by designating a

qualified beneficiary, investments may be exempt

from creditors in the event of bankruptcy or

litigation

Who are Segregated Funds

for?

- Pre-retirees looking for wealth accumulation but want to avoid potential losses with maturity and death guarantees

- Individuals looking to preserve their legacy and transfer their estate in a timely, private, and cost-effective manner

- Business owners looking for creditor protection planning

- Anyone who wants the ability to achieve the same type of investment returns as mutual funds but with the security and protection in knowing that their money is protected against any uncertainty

Segregated Funds vs Mutual Funds

|

Investing helps you be more secure and confident about your financial situation. It is not a one-day initiative but rather a continuous long-term activity. The earlier you start investing, the more well-equipped you’ll be in the future. I wish to work together with you and help put the roadmap in place that will help guide you towards your financial goals. Let’s get started!

ESG Investing

More and more, Canadians want their investments to

reflect their personal values and we want our

investments to have an impact for positive change in

the world.

There are many approaches to responsible investing,

including:

Climate change

- Women in leadership

- Community development

- Excluding fossil fuels, weapons, and vices

Companies that perform well on environmental, social

and governance screens may also experience higher

profitability and lower volatility. It’s entirely

possible to do well by doing good.

How can you choose responsible investment funds?

Providers of investment funds use a variety of

approaches to incorporate values-based responsible

investing into their investment processes. As an

independent financial advisor, I can recommend

investment funds that invest in companies who:

- promote environmental sustainability and reducing carbon footprint

- foster social justice and responding to concerns of local communities

- have an independent board of directors and a

diverse management team

If you’d like to review your portfolio and discuss how ethical or values-based funds might fit in your portfolio, please phone me.

Benefits of Segregated Funds

As you know, I’ve helped you manage your risk be it

with life insurance, critical illness, or disability

insurance. I also have expertise in helping you with

your investments and managing risk there too. As an

independent insurance advisor, I’m uniquely

qualified to offer you segregated funds, which are

an investment product with principle guarantees,

lifetime income options, and protection against

premature death.

Segregated Funds: Investing

with peace of mind

Segregated Funds can only be sold by a licensed

insurance advisor. They are similar to mutual

funds but have guarantees and advantages that mutual

funds do not.

Guarantees

A segregated fund policy includes both a maturity

guarantee and a death benefit guarantee. These

guarantees range from 75% to 100% of your principal

investment.

Increasing your guarantees

Segregated funds can include reset options. This

allows you to increase your guarantee values to a

percentage of the market value, thus locking in your

guarantees.

Potential creditor protection

Investments within a segregated fund may be

protected from your creditors, in the case of

bankruptcy or a lawsuit. This feature is

especially important for small business owners and

self-employed professionals

Privacy of your assets

When you pass away some of your investments are

subject to probate and becomes public record.

Segregated funds allow you to bypass probate and

keep those assets private.

Efficient estate planning

By using a segregated fund with a named beneficiary

the proceeds are paid directly to the beneficiary

bypassing probate, thus saving fees and time

allowing the assets to quickly pass to those that

need it the most.

Lifetime income options

Some segregated funds feature lifetime income

options to guard against market risk in retirement

or when guaranteed income is needed.

Who can benefit from owning Segregated

Funds?

- Long-term savers looking to mitigate risk

- Business owners and self-employed professionals

- Retirees

- People planning for their estate

- Those looking for guaranteed income

Let me help you make the best choices based on your needs and your situation.

TFSA

A Tax-Free Savings Account (TFSA) is a personal

savings account that can be used to save for any

goal. After-tax money can go into a TFSA, but

your investments grow tax-free and you won’t pay

any tax on withdrawal.

Who should invest in a TFSA?

- Canadians who have reached the age of majority

- Great for short term, medium-term, and long-term savings

- Best suited for low to medium-income

earners or as a complement to an RRSP

Benefits include:

Earn investment income,

tax-free - Interest, capital

gains, dividends you earn in the account are not

subject to tax

Flexibility to withdraw from

TFSA - Withdrawals are

tax-free and can be at any time, for any purpose

that you choose

Flexible savings plan - Any

unused contribution room in TFSA can be carried

forward. Any withdrawals from a TFSA in one

year, can be recontributed in the next calendar

year

Government benefits stay the same -

Withdrawing from a TFSA and receiving

any amount will not affect the government

benefits you get (ex. Child tax benefit, GIS,

etc.). Current contribution limit per year is

$7,000 as of 2024 and $95,000 if at least 18

years old in 2009 and never contributed to a

TFSA.

Let me help you make the best choices based on

your needs and your situation.

Registered Retirement Savings Plan

The Registered Retirement Savings Plan (RRSP), is a

personal savings plan that lets you save money over

your lifetime on a tax-sheltered basis, so your

money grows faster.

Who should invest in a RRSP?

- Canadians under 71 years of age who earns employment income and wants to save for retirement by reducing their tax bill

- Great for long-term retirement goals and generating ongoing income in your later years

- Best suited for medium to high income earners

Reasons why you should invest in an

RRSP:

Tax-deductible contributions

- Claim your RSP contributions as a deduction on your tax return

- Can carry forward deduction from contribution to future years when income might be higher

Tax-free growth

- Won’t have to pay any taxes on investment gains as long as it remains in the RSP

- Allows retirement savings to grow faster

Generate retirement income for

stability

- When you’re ready to retire, you can convert your RSP to a RRIF or annuity to receive regular payments

- Income from the RRIF will be taxable but in your

later ages, you will potentially be in a lower

tax bracket and pay less tax

Spousal RSP benefits

- Split income in the household by contributing into spousal RSP

- Retirement income can be split more equally

between you and your spouse, generating a

reduced amount of tax that higher income earner

pays

Government withdrawal benefits

- Make withdrawals without paying any tax if you pay the money back within the specified time periods for:

- Home Buyers Plan – withdraw from your RSP to contribute towards your first home purchase

- Lifelong Learning Plan – withdraw from your RSP

to contribute towards education costs

Let me help you make the best choices based on your needs and your situation.

RRSP Loan

An RSP loan can help make sure you’re taking

advantage of RSP tax-deferred investing.

Maximizing your annual RRSP contribution is one of

the best ways to build a secure

retirement.

It could make sense to borrow from your RSP

if you:

- Are looking for a smarter way to manage contributions and cash flow

- Missed making your full contribution in a previous year

- Have a lot of catching up to do

Advantages of RSP Loans:

- Great way for you to meet your retirement goals

- Allows you to maximize the benefit of saving for your retirement

- Increase the potential tax refund that you receive

- Utilize unused contribution room from past years to accelerate tax-deferred savings

- Maximize investment opportunities with a larger access of cash to invest

- Easy term set up, generally can benefit from lower rates than usual during RSP season

A few RSP Loan features include:

Reduce your taxes - By making a

contribution up to your maximum contribution amount,

it may help to reduce the taxes that you are

required to pay

Repayment schedule - Choose a

repayment schedule that works for you

Interest rate options - Choose

between a fixed or variable interest rate

Deferred payment option - Defer

when the payments start; but interest still accrues

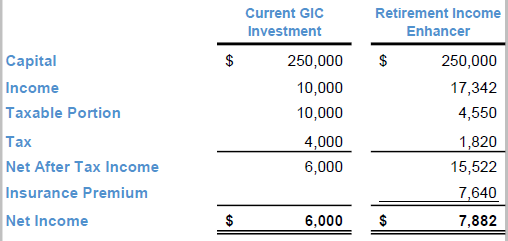

Retirement Income Enhancer - Insured Annuity

You are nearing or in your retirement years and want:

- Guaranteed Supplemental Retirement Income

- 100% Capital Preservation

A guaranteed income certificate (GIC) will work

perfectly. The problem is that GIC revenue is

interest income and is taxed at your marginal tax

rate. Also, in today’s interest rate

environment, you will earn approximately 4.0% before

tax.

An alternative is to take your lump sum of cash used

to invest in a GIC and purchase a life

annuity. This pays you a regular income for

the rest of your life. You then use a portion

of that preferentially taxed annuity income to

purchase a permanent life insurance contract.

This will replace the money used to purchase the

annuity when you pass away. This strategy will

typically produce a pre-tax rate of return between

5%-6% and is guaranteed for life.

Benefits of the Retirement Income

Enhancer

- Higher amount of net spendable income

- Income guaranteed for life

- Preferential tax treatment on the annuity income

- Capital replaced at death and paid directly to your heirs

- Beneficiaries can be changed at any time

- No probate fees on the life insurance death

benefit

Example:

- Male 65 non-smoker regular health

- Non-Registered Funds

- GIC rate= 4.0%

- Marginal Tax rate= 40%

An increase of 31% or $1,882/year

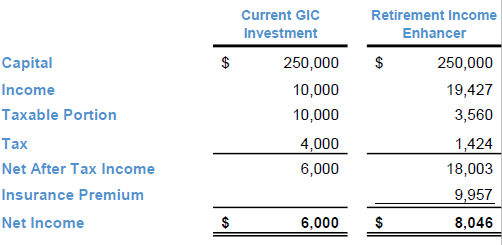

Example:

- Male 70 non-smoker regular health

- Non-Registered Funds

- GIC rate= 4.0%

- Marginal Tax rate= 40%

An Increase of 34% or

$2,046/year

Rates are from July 2023 and are subject to

change.

If you are interested in discussing this strategy

and to see if it works for you, please let me know.

Enhance Your Charitable Giving Using Life Insurance

According to Statistic Canada, over $10,000,000,000 was donated from 5,000,000 Canadians to charity in 2019. All these donations are eligible for a non-refundable tax credit.

By using Life Insurance, you can increase your overall charitable donation benefiting a cause that really means something to you. Donating funds to the Canada Revenue Agency through taxation just doesn’t provide the same legacy.

Enhance Your Charitable Giving Using Life Insurance

Below are two structures that allow you enhance your donation to the charity of your choice and potentially pay less tax.

Personally Owned Life Insurance:

- Purchase a Life Insurance policy where you are the owner/payor of the policy with your chosen charity as the beneficiary.

- Policy growth is tax-free increasing your overall donation.

- When you die the charity receives the death benefit tax-free.

- Your estate receives a tax credit of up to 100% of net income for both the year of death and the year immediately preceding it.

- You have access to the cash value during your life as the owner of the policy.

- Can change the beneficiary at any time.

Charity owned Life Insurance:

- Purchase a Life Insurance policy and make the charity the owner and beneficiary. You pay the premiums.

- Every year you receive a tax credit in the amount of the premium paid.

- Maximum donation credit is 75% of net income per year while living.

- Unused credits can be carried forward up to 5 years.

- Charity has access to cash value and they control the policy.

Case

Study

Personally Owned Life Insurance vs a

Non-Registered Investment (Balanced Fund)

|

Comparison Age: 85 | Total

Investment: $500,000 |

|||

| Non-Registered Investment | Life Insurance | ||

| Total Donation to Charity | One time tax credit on death | Total Donation to Charity | One time tax credit on death |

| $907,224 | $435,130 | $1,027,431 | $492,793 |

| Charitable Donation Increase using Life Insurance:$120,202 | |||

Using Life Insurance, you have enhanced your charitable contribution by 13.25% and increased your tax credit by $57,663 that can be used to reduce estate taxes and increase the amount your beneficiaries receive.

Case Study

Charity Owned Life Insurance VS Charity Held

Investment (2% Growth rate as charities have

disbursement quotas limiting the ability for

compound growth)

|

Comparison Age: 85 | Total

Contribution: $500,000 |

|||

| Charity Held Investment | Life Insurance | ||

| Total Donation to Charity | Total Tax Credit | Total Donation to Charity | Total Tax Credit |

| $684,069 | $238,531 | $1,027,431 | $238,531 |

| Charitable Donation Increase using Life Insurance:$343,363 | |||

Using Life Insurance, you have enhanced your

charitable contribution by 33.42%.

The option you choose is dependent on your income

tax situation and where you want to use the

non-refundable tax credit (annually or at the time

of death). With both options, the legacy that you

can provide a charity has been significantly

increased.

If this is something that resonates with you, please

reach out to discuss enhancing your legacy.

Protecting your Retirement Income from an Unforeseen Health Risk

We know most people will make it to retirement without suffering a major illness but if you are one of the unlucky ones, what happens now?

Would you forego 1% of your annual rate of return to eliminate this risk?

Sure, you could use your savings or take out a loan to cover the unexpected costs, however, both options will have a significant impact on your retirements plans. If you need to access your registered funds, they are taxed in the year you use them. Accessing those funds prior to retirement is not part of your plan.

Pass on that risk to an insurance company. They will take care of the rest with an illness recovery benefit. This is a tax-free lump sum payment to cover any number of unforeseen expenses. No need to submit receipts or to justify the costs.

Keep your retirement goals on track

If you are diagnosed and survive a major illness like cancer, heart attack or stroke, you receive an illness recovery benefit payment. This will keep your retirement goals on track.

Below is an example of a typical 40-Year-old, on track, saving for retirement.

After diagnosis, he/she needs to access 100k from their registered account at age 55 to cover additional costs associated with fighting an unfortunate cancer diagnosis. The impact is significant:

Take 1% of your annual rate of return to pay the premium. Your future self and family will be grateful if the worst happens.

Generational Wealth Transfer - Using permanent insurance

You already have excess wealth that you plan to pass on to the next two generations. You want them taken care of financially and have likely earmarked a portion of your investment portfolio for them.

One issue that arises is that all non-registered investment growth is eroded by taxation.

A tax-free permanent insurance policy can make sure your financial legacy extends all the way to your grandchildren.

Have you considered a generational wealth transfer using permanent life insurance? You can take out an insurance policy on your adult children and investment growth in these plans is not subject to annual taxation, increasing your overall wealth. As the owner of the plan, you control money growing inside and can access it during your lifetime if needed.

Your Child

When you purchase the plan and insure your child, they have a valuable asset right away: life insurance protection. You can transfer the policy to them at any time tax free, however most people will transfer the policy at the time of their passing. This is done seamlessly by naming them as a contingent owner on the plan. As the new owner, they now have access to all the money that is growing inside the policy. This money can be used to help buy a home, supplement their retirement, or help fund their child’s education.

Your Grandchild

By naming them as the beneficiary on the policy, you have helped put a foundation in place they can build on. As the named beneficiary on the policy at the time of your adult child’s death (hopefully well into the future) your grandchild will receive the death benefit proceeds tax-free.

This is a great way to help extend your financial legacy. You worked hard to earn it. Make sure your loved ones are the beneficiaries.

Protecting your Retirement Income from an Unforeseen Health Risk

We know most people will make it to retirement without suffering a major illness but if you are one of the unlucky ones, what happens now?

Would you forego 1% of your annual rate of return to eliminate this risk?

Sure, you could use your savings or take out a loan to cover the unexpected costs, however, both options will have a significant impact on your retirements plans. If you need to access your registered funds, they are taxed in the year you use them. Accessing those funds prior to retirement is not part of your plan.

Pass on that risk to an insurance company. They will take care of the rest with an illness recovery benefit. This is a tax-free lump sum payment to cover any number of unforeseen expenses. No need to submit receipts or to justify the costs.

Keep your retirement goals on track

If you are diagnosed and survive a major illness like cancer, heart attack or stroke, you receive an illness recovery benefit payment. This will keep your retirement goals on track.

Below is an example of a typical 40-Year-old, on track, saving for retirement.

After diagnosis, he/she needs to access 100k from their registered account at age 55 to cover additional costs associated with fighting an unfortunate cancer diagnosis. The impact is significant:

Take 1% of your annual rate of return to pay the premium. Your future self and family will be grateful if the worst happens.

Simplifying insurance coverage - Rent, Lease or Own

At times, it can feel like Life Insurance Companies have overcomplicated the products they provide by using fancy names and acronyms.

This has left many Canadians feeling confused. Fundamentally, there are only three plan types to choose from when purchasing life insurance. You can rent, lease or own the insurance. Below is an explanation of the merits of each which will hopefully provide clarity and make decision making easier.

The right life insurance solution for you depends on your immediate needs and long-term goals. Term life insurance and permanent life insurance are two very different kinds of protection that satisfy different needs.

Renting Life Insurance

The first and most important decision is to cover off your debt and lost income if something were to happen in the short to mid-term. This is called term insurance. Think of this like anything you rent (Car, House, Boat, Skis). You pay a lower amount than purchasing the item outright and when you don’t need it anymore or your rental time is up, you give it back. That is it. Term insurance is the exact same. You pay a lower amount for access to a higher amount of coverage because you hope you don’t have to use it. You can lock in term (rental) rates anywhere from 5-50 years depending on your situation.

Highlights:

- Low initial cost

- Pays out only if the insured dies

- Rates usually go up after the term

- Plan expires at a certain age

Leasing Life Insurance

The next option is to look at permanent insurance. This plan is guaranteed to pay out at some point in the future. Think of this as a lifelong lease. When leasing a property, you might lock in a 5-year lease. Here you are locking in a rate today (more expensive than the rental option) for the rest of your life.

Highlights:

- Level premium for lifetime

- Coverage never expires

- You control the policy: company can’t change or terminate it

Owning Life Insurance

The third type of insurance is where you own an equity portion inside the

policy. Think of it like owning a house. When you take out a mortgage on a

property you pay the bank a monthly amount until your mortgage is paid off and

you “own” your house free and clear. With this type of insurance, you pay a

monthly/annual premium (higher than the lease option as part of your deposit is

invested). Each year, the investment component grows tax-sheltered and that is

what you “own”. Think of it as the "equity" in your life insurance, similar to

the equity in your home. You can structure the plan to have a “limited” payment

period (usually 10-20 years) or choose to pay for life. This “Cash Value” is

yours and will continue to grow over time.

Highlights:

- Guaranteed 10, 15 or 20 pay

- Coverage never expires

- Cash values and loan values

- You control the policy: company can’t change or terminate it

As a recap, there are only 3 structures when it comes to life insurance (Rent, Lease, Own). If you would like to discuss this in more detail, please feel free to reach out and we can find a solution that meets your family’s needs.

Which job would you choose? Job A or Job B?

You have been offered a job and get to pick between two different compensation structures. Which one are you choosing?

Job A will pay you $80,000/year while working and $0 if you are unable to work due to an injury or illness.

Job B will pay you $78,500/year while working and $53,000 (tax-free) if you are unable to work due to an injury or illness.

With an Income Replacement Benefit, you create a safety net around you and your family. You own and control the policy and the rates are guaranteed until you turn 45.

This chart illustrates your earning potential during your working years. If you are unable to work due to an illness or injury, you still need a regular monthly income. Put the insurance company’s money to work so your family can maintain the same standard of living.

Your Earning Potential by age 45:

|

Annual Income |

At Age 25 |

At Age 35 |

At Age 45 |

|

$35,000 |

$2,359,089 |

$1,536,595 |

$894,063 |

|

$50,000 |

$3,370,128 |

$2,195,135 |

$1,277,233 |

|

$65,000 |

$4,381,166 |

$2,853,676 |

$1,660,403 |

|

$90,000 |

$6,066,230 |

$3,951,243 |

$2,299,019 |

|

$120,000 |

$8,088,306 |

$5,268,324 |

$3,065,359 |

|

$150,000 |

$10,110,383 |

$6,585,405 |

$3,831,699 |

- Assumes an annual increase of

2.5%

This strategy works for all income levels and most occupations. If you want to learn more, please reach out to discuss further.

Why and When to own Corporate Owned Permanent Insurance

When should you consider Participating Whole Life Insurance inside your Corporation?

- You're a significant shareholder in a Canadian Controlled Private Corporation

- Age 40+ and healthy

- Corporation has excess annual cash flow and/or investment assets not needed for business purposes. Typically, been in business for at least 5 years.

- Want to maximize your estate and transfer assets in a tax-efficient manner

- Looking for stable and predictable asset growth (asset diversification)

Suitability Reasons

The more checkmarks the greater the need for this strategy.

✔️ Business Succession plan in place?

✔️ Reduce tax on corporate investment income?

✔️ Desire to pass corporate assets to a beneficiary?

✔️ Have a corporate life insurance need?

✔️ Own taxable passive investment assets?

✔️ Own corporate investments with a deferred capital gain?

✔️ Want a certain amount of estate value guaranteed?

Comparing a traditional investment to participating whole life insurance while living and at death

Traditional Investment While Living:

- Taxes payable on investment income: Interest, dividends, realized capital gains

- Passive investment income: Pay the highest corporate tax rate, no small business deduction

Traditional Investment At Death:

- Taxes payable on deferred capital gains

- Taxes payable on transfer to shareholders estate

Participating Whole Life Insurance (Alternative asset class) While Living:

- Policy earnings grow tax-exempt up to government prescribed limits

Participating Whole Life Insurance (Alternative asset class) At Death:

- All policy proceeds are paid tax-free to the corporation (no deferred gains)

- Death benefit minus adjusted cost base paid out tax-free to shareholders estate through a notional Capital Dividend Account

Life insurance is Wealth Protection

Total Wealth = human capital + financial capital

Leverage a Permanent Insurance Policy - Immediate Financing Arrangement

Do any of the below resonate with you?

- I hold traditional investments inside my holding/operating company

- I am looking to diversify my holdings towards an alternative tax advantaged asset class

- I want to increase the internal rate of return on my estate plan.

- I want to maximize the Capital Dividend Account balance (corporate IFA).

- I have an existing permanent insurance plan with cash value and want access today.

- I want to set up a charitable giving strategy without affecting cash flow.

Did you know that you can leverage permanent life insurance policies

using immediate financing arrangements?

This is a sophisticated strategy for high-net-worth individuals or

corporations that involves leveraging your permanent insurance plan so annual

cash flow is not adversely affected.

How an IFA works

- You enter into a contract for a permanent life insurance policy which creates significant Cash Surrender Value (CSV) in the policy’s early years.

- The policy is assigned to a Bank as collateral to secure a line of credit.

- You pay the annual recurring insurance premium.

- You borrow back up to 100% of the CSV. (Or borrow back the entire premium by providing additional collateral security.)

- You use the line of credit for investment purposes – for example, to fund an operating business, purchase real estate or invest in a nonregistered investment portfolio.

- Steps 3-5 are repeated annually.

- When you pass away, the outstanding loan is repaid out of the death benefit and the remaining proceeds are paid to your beneficiaries.

The two most common IFA structures

100% Cash Surrender Value Lending

With this strategy, you borrow only 100% of the CSV of a policy each year which

is, of course, less than the premium payment. The advantage to this structure is

that the CSV of the policy creates a rapidly increasing borrowing capacity over

time. The drawback is that there is a significant net funding requirement from

you in the early years of the policy.

100% Replacement of Premium

With this strategy, you pay the annual premium then provide extra collateral

security – in addition to the CSV of the policy – in order to borrow back 100%

of the premiums each year. The advantage of this structure is that you

experience only a modest net cash outflow (net annual interest costs) in

comparison to the death benefit, which increases the rate of return of the

structure. The drawback is the requirement to provide additional collateral

security. (However, the additional collateral security requirement may well fall

and eventually disappear over time.)

Individually Owned Life Insurance vs. Mortgage Insurance

When taking out a mortgage with a lending institution you should cover off that debt with an insurance policy. Not all coverage options are created equal. Let’s look at the highlights of the two options available to you.

Control

Individually Owned Term Life Insurance: You own the coverage and choose who receives the death benefit

Mortgage Insurance from Lender: Lender owns the policy and they are the beneficiary

Guaranteed Premiums

Individually Owned Term Life Insurance: Your rates are

guaranteed for the life of the policy

Mortgage Insurance from Lender: Mortgage insurance rates are

not guaranteed and can increase

Portability

Individually Owned Term Life Insurance: Coverage remains intact

if you switch lenders

Mortgage Insurance from lender: You need to reapply for

coverage if you move lenders

Level Coverage Amount

Individually Owned Term Life Insurance: Coverage amount stays

the same even as your mortgage decreases

Mortgage Insurance from Lender: Coverage declines as your

mortgage is paid off. Premiums stay the same

Comfort

Individually Owned Term Life Insurance: Underwritten at the time

of application. No surprises at the time of claim

Mortgage Insurance from lender: Underwritten at the time of

death

Reach out to me today if you want to explore the benefits of individually owned life insurance.

Critical Illness Insurance - A Forced Savings Plan

Protection from a major health event and a little forced savings for your healthy future self.

One of the unique features in the Canadian living benefit insurance market is the ability to receive all your premiums back if you don’t claim on the contract.

Did you know?

With this product, you get a cheque from the insurance company for every premium dollar you paid over the life of the contract. There is no other insurance product that allows you to receive all your premiums back if you don’t use it.

EXAMPLE

In the below example, during the 35 years of coverage, you are entitled to $100,000 if you survive a major illness such as Cancer, Heart Attack, or Stroke. There are many more covered conditions, however, these three are the most common that people will claim on.

|

Major Illness Recovery Benefit |

Female age 40 |

|

Coverage to age 75 |

$100,000 |

|

Annual Premium |

$1,700/year |

|

Total Premium returned @ age 75 |

$59,500 |

Invest in Your Child’s (Grandchild’s) Future

When building a house, you start with a solid foundation before you start framing the structure. Below are two ways your child’s (grandchild’s) financial foundation can be set up for success.

Option 1A - RESP

A Registered Education Savings Plan (RESP) can be part of every family’s financial plan. The Government will contribute 20% of your contributions up to $500/year. You contribute $2,500 and $3,000 is invested in a tax-deferred account. A 20% rate of return before the funds are even invested.

A $7,200 cap on government contributions up until your child turns 18.

You can contribute up to $50,000 per child and have 35 years to use the funds.

When your child goes to post-secondary school the income received is taxed in their hands (little or no tax consequences as they are not likely earning much while attending school).

One minor drawback, if your child does not attend a qualified post-secondary institution and you want to close out the account all grants received and any investment growth those funds received are returned to the government.

Your contributions are not taxed, however any investment growth earned on those funds is considered interest income and is taxed accordingly.

Option 1B - Permanent Life Insurance

Purchasing a cash value life insurance policy also has a tax deferred investment account built into the plans structure. While there is no government grant, there is also no $50,000 lifetime contribution limit or restriction on what the funds can be used for.

- Help Start a business (Walt Disney (Disneyland), Ray Kroc (McDonalds) both leveraged their WL policies and they did alright)

- Down payment for their first house.

- Funds to travel.

- Buy their first car.

- Help pay for any type of education.

Also, your child now has the added benefit of being insured no matter their health, occupation, or hazardous hobbies they take on in the future. This factor is often overlooked until too late for some. Giving the gift of guaranteed insurability is priceless.

Example:

Contribute $2,500 per year for 17 years from birth into each product. Assume a 5% annual rate of return and no additional contributions.

RESP plan with $42,500 in contributions will be worth $86,000 (Including $7,200 Government Grant) by the time your child goes to school. This is the best option available to pay for tuition and other eligible expenses.

An example illustrating Participating Whole Life Values are noted below using $42,500 in total contributions. The cash value can be accessed at any time for any purpose. This is your asset and you have control over the use of the funds. In addition your child has a death benefit that continues to grow every year.

| Year | Participating WL Cash Value | Participating WL Death Benefit |

|---|---|---|

| 18 | $44,163 | $322,171 |

| 25 | $63,351 | $369,600 |

| 30 | $78,677 | $409,467 |

| 35 | $99,828 | $447,076 |

| 40 | $126,036 | $483,383 |

| 45 | $158,365 | $519,503 |

| 50 | $197,538 | $556,579 |

| 55 | $245,828 | $595,278 |

| 60 | $304,427 | $636,505 |

| 65 | $373,813 | $681,334 |

• 20 pay WL product max funded for 17 years. Current -1% Dividend Rate

Please reach out to discuss your child’s financial

foundation.

Are You Insuring Your Most Valuable Asset?

Ask the average Canadian what their most valuable asset is, and if you are a

homeowner, you would likely say your principal residence. While that is

likely true when it comes to something tangible you can buy or sell, it is far

from your most valuable asset.

Your ability to earn an income is your most important asset. This chart

illustrates your total earning potential until age 45 based on your annual

income and current age. When illustrated this way, you can grasp the

significance of how valuable you are.

Your Earning Potential by age 45:

| Annual Income | At Age 25 | At Age 35 | At Age 45 |

| $35,000 | $2,359,089 | $1,536,595 | $894,063 |

| $50,000 | $3,370,128 | $2,195,135 | $1,277,233 |

| $65,000 | $4,381,166 | $2,853,676 | $1,660,403 |

| $90,000 | $6,066,230 | $3,951,243 | $2,299,019 |

| $120,000 | $8,088,306 | $5,268,324 | $3,065,359 |

| $150,000 | $10,110,383 | $6,585,405 | $3,831,699 |

Assumes an annual increase of 2.5%

Now, if due to a prolonged illness or injury you are unable to work, would it

make sense to insure your ability to earn an income?

52% of Canadians do not have any coverage through an employer and of the 48% who

have a group insurance plan, is that coverage enough to cover your monthly

expenses?

Scenarios to consider purchasing individually owned Disability Insurance:

- Uncomfortable with “definition” of disability of your group plan or the fact that your employer is the owner of the plan and can change or cancel it at any time

- A business owner who relies on uninsured income sources like corporate profits and dividends

- Have group coverage, however, are unable to insure the necessary amount of income due to plan limits

There are 3 options available depending on your situation:

- Purchase an individually owned plan that will cover majority of your lost income (can be personal or business income)

- Purchase an individually owned plan as a top-up for the shortfall of your group coverage (the higher your income the more likely this scenario will come into play)

- Purchase an individually owned plan as an offset to your group coverage that can be relied upon should your group coverage end for any number of reasons (premium discounts available)

Group Top-Up Using Individually Owned Disability Insurance:

No Insurance or Group Offset:

Insuring the Full Amount Available Using Individually Owned Disability Insurance

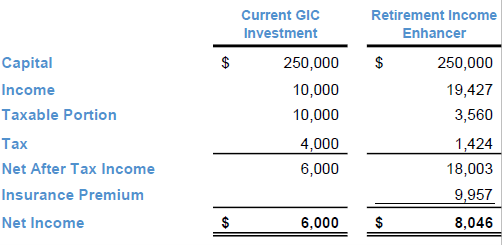

Retirement Income Enhancer - Insured Annuity

You are nearing or in your retirement years. If you are like most Canadians, you may be looking for:

- Guaranteed supplemental retirement income

- Ways to guarantee you don’t lose any of your hard-earned money

A guaranteed income certificate (GIC) will work perfectly. The problem is

that GIC revenue is interest income and is taxed at your marginal tax

rate. Also, in today’s interest rate environment, you will earn

approximately 4.0% before tax.

An Alternative is to take your lump sum of cash used to invest in a GIC and

purchase a life annuity. This pays you a regular income for the rest of

your life. You then use a portion of that preferentially taxed annuity

income to purchase a permanent life insurance contract. This will replace

the money used to purchase the annuity when you pass away. This strategy

will typically produce a pre-tax rate of return between 5%-6% and is guaranteed

for life.

Benefits of the Retirement Income Enhancer

- Higher amount of net spendable income

- Income guaranteed for life

- Preferential tax treatment on the annuity income

- Capital replaced at death and paid directly to your heirs

- Beneficiaries can be changed at any time

- No probate fees on the life insurance death benefit

Example:

- Male 65 non-smoker regular health

- Non-Registered Funds

- GIC rate= 4.0%

- Marginal Tax rate= 40%

An increase of 31% or $1,882/year

Rates are from July 2023 and are subject to change

Example:

- Male 70 non-smoker regular health

- Non-Registered Funds

- GIC rate= 4.0%

- Marginal Tax rate= 40%

An Increase of 34% or $2,046/year

Rates are from July 2023 and are subject to change

If you are interested in discussing this strategy to see if it works for you,

please let me know.

Enhance Your Charitable Giving Using Life Insurance

According to Statistic Canada, over $10,000,000,000 was donated from 5,000,000 Canadians to charity in 2019. All these donations are eligible for a non-refundable tax credit.

By using Life Insurance, you can increase your overall charitable donation benefiting a cause that really means something to you. Donating funds to the Canada Revenue Agency through taxation just doesn’t provide the same legacy.

Enhance Your Charitable Giving Using Life Insurance

Below are two structures that allow you enhance your donation to the charity of your choice and potentially pay less tax.

Personally Owned Life Insurance:

- Purchase a Life Insurance policy where you are the owner/payor of the policy with your chosen charity as the beneficiary.

- Policy growth is tax-free increasing your overall donation.

- When you die the charity receives the death benefit tax-free.

- Your estate receives a tax credit of up to 100% of net income for both the year of death and the year immediately preceding it.

- You have access to the cash value during your life as the owner of the policy.

- Can change the beneficiary at any time.

Charity owned Life Insurance:

- Purchase a Life Insurance policy and make the charity the owner and beneficiary. You pay the premiums.

- Every year you receive a tax credit in the amount of the premium paid.

- Maximum donation credit is 75% of net income per year while living.

- Unused credits can be carried forward up to 5 years.

- Charity has access to cash value and they control the policy.

Case Study

Personally Owned Life Insurance vs a Non-Registered Investment (Balanced

Fund)

|

Comparison Age: 85 | Total

Investment: $500,000 |

|||

| Non-Registered Investment | Life Insurance | ||

| Total Donation to Charity | One time tax credit on death | Total Donation to Charity | One time tax credit on death |

| $907,224 | $435,130 | $1,027,431 | $492,793 |

| Charitable Donation Increase using Life Insurance:$120,202 | |||

Using Life Insurance, you have enhanced your charitable contribution by 13.25% and increased your tax credit by $57,663 that can be used to reduce estate taxes and increase the amount your beneficiaries receive.

Case Study

Charity Owned Life Insurance VS Charity Held Investment (2% Growth rate

as charities have disbursement quotas limiting the ability for compound

growth)

|

Comparison Age: 85 | Total Contribution: $500,000 |

|||

| Charity Held Investment | Life Insurance | ||

| Total Donation to Charity | Total Tax Credit | Total Donation to Charity | Total Tax Credit |

| $684,069 | $238,531 | $1,027,431 | $238,531 |

| Charitable Donation Increase using Life Insurance:$343,363 | |||

Using Life Insurance, you have enhanced your charitable contribution by

33.42%.

The option you choose is dependent on your income tax situation and where you

want to use the non-refundable tax credit (annually or at the time of death).

With both options, the legacy that you can provide a charity has been

significantly increased.

If this is something that resonates with you, please reach out to discuss

enhancing your legacy.

.jpg)

Insurance Advisor & Financial Services

Office: 705-495-3980

Mobile: 705-498-0431

Email: tony@tibrafinancial.com

Social media:

My name is Tony Bruno and I am an Insurance Advisor and also provide Financial

Services. I have almost 30 years of experience in the Financial Services

Industry. I provide valuable service to clients in the area of Life Insurance,

Group Benefits and Retirement Planning. I have also completed the Insurance and

Advisors Training Course along with the Canadian Securities Course. I have

obtained the Elder Planning Counsellor designation (www.elderplanningcounselor.com). My company, Tibra

Financial Inc., is a licensed Insurance Agency in the province of Ontario under

the Managing General Agency (MGA) HUB Financial Inc.

I was born and raised in North Bay, ON and along with my wife, have three

daughters. I enjoy sports such as soccer, hockey, motor racing and of course the

NFL.

Carriers: Manulife Financial, ivari Canada, BMO Life

Assurance of Canada, Canada Life, Empire Life, Industrial Alliance Life,

Equitable Life, Foresters Financial, Sun Life, Desjardins Financial, RBC Life

Insurance, Assumption Life, Ontario Blue Cross, Canada Protection Plan (Owned by

Foresters Financial)

Special Risk/High Limit Needs: Hunter McCorquodale

Specialty Carriers: Humania Assurance, Edge Benefits (Cl with no underwriting) My Dignity (Simplified LTC Product), Specialty Life Insurance

Critical Illness - Laurence's story

Three years ago, Laurence was diagnosed with prostate cancer. This is his story.